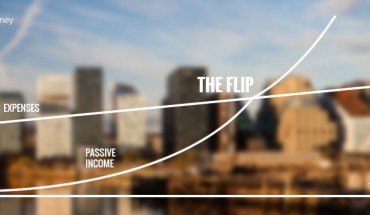

2016 is coming to an end and I feel so happy that I acted and took the time and energy to really kick off The Flip. As always it became a bigger project than anticipated. I thought that I would be able to write down my strategies and sum everything up in a couple of weeks but it ended up being a full-time effort for a month and something I have tinkered with every single day for the last four months after work.

But the most surprising was how much I learned and realized along the way. Writing your ideas down as if to share them with others, whether you do it or not, makes you want to formulate the entire idea and think about it from different perspectives. It gives you a cue to stop and think about why you do something, understand it and dig deeper to see if there’s something more to be understood or added.

Dividend growth stocks

Based on the fundamentals of the company, the value from owning it and the price, these are our top investment ideas for a dividend growth passive income portfolio for December 2016:

- Target Corp. (NYSE:TGT)

- Ameriprise Financial Inc. (NYSE:AMP)

- CVS Caremark (NYSE:CVS)

- Hasbro Inc. (NYSE:HAS)

- Qualcomm Inc. (NYSE:QCOM)

- Bonus: Iron Mountain Inc. (NYSE:IRM)

Target Corporation has 45 years of dividend increases with a current payout ratio of 44.0% and a consensus analyst five year EPS growth estimate of 6.0% per year. Their current yield is at 3.1% with an average annual dividend growth rate of 20.8% over the last five years. The stock is trading below fair value at a price of $77.13.

CVS Caremark has 13 years of dividend increases with a current payout ratio of 42.62% and a consensus analyst five year EPS growth estimate of 10.7% per year. Their current yield is at 2.53% with an average annual dividend growth rate of 32.0% over the last five years. The stock is trading below fair value at a price of $79.00.

Ameriprise Financial Inc. has 12 years of dividend increases with a current payout ratio of 40.9% and a consensus analyst five year EPS growth estimate of 9.1% per year. Their current yield is at 2.7% with an average annual dividend growth rate of 29.5% over the last five years. The stock is trading below fair value at a price of $112.91.

Hasbro Inc. has 13 years of dividend increases with a current payout ratio of 48.5% and a consensus analyst five year EPS growth estimate of 11.4% per year. Their current yield is at 2.6% with an average annual dividend growth rate of 13.8% over the last five years. The stock is trading below fair value at a price of $80.01.

Qualcomm Inc. has 14 years of dividend increases with a current payout ratio of 55.7% and a consensus analyst five year EPS growth estimate of 10.5% per year. Their current yield is at 3.2% with an average annual dividend growth rate of 20.2% over the last five years. The stock is trading below fair value at a price of $67.16.

Bonus: Iron Mountain Inc. is a REIT focused on enterprise storage. The current yield is 6.82% at a price of $32.41 with a good outlook to increase it further over the next couple of years.

Qualcomm

This month we’ve chosen to highlight Qualcomm who’s designing and building much of the technology that the mobile revolution we’re currently living in relies on. The company started its life in 1985 when it made tracking and messaging products and services for the long-haulage trucking industry. Now they are mostly known as a fabless semiconductor company with their processors, modems and related technology in many, if not most, of the world’s high-end smartphones.

Although most of the revenue comes from selling physical products, like semiconductors, most of the profits comes from intellectual property licensing. Qualcomm has many of the patents behind 3G mobile connectivity as well as CDMA 4G (the system used in the U.S.). This is one reason why many of the high-end smartphones use Qualcomm’s Snapdragon system-on-chips, the modem for connecting to the cellular network is integrated with the processor for a more optimized total package.

Throughout its history the company has been quite aggressive in finding out where the mobile and connected world is heading and through acquisitions has positioned themselves to be a central player both when it comes to technology as well as the product platform. This has led to instances where they are fined for being too dominant in the market. For example, on December 28th 2016 they were fined a record amount by the South Korean authorities for what they see as unfair patent licensing terms. It’s been appealed by Qualcomm so where everything ends this time is not yet settled, but the facts are that this kind of thing pops up every now and then for the company.

Qualcomm brings in a lot of money, current trailing twelve month revenue is at $23.55 billion. This translates to $3.81 in earnings per share, and $4.76 in levered free cash flow per share, which leaves lots of room for dividend increases from the current level of $2.12 per share if the payout ratio is expanded. Expected five year growth is at 10.50% per year which will be the main driver for dividend increases though. Qualcomm is financially solid with $18.65 billion in cash and $11.76 billion in debt.

They have increased their dividends for 13 years and looks to continue this streak.

For the future, Qualcomm is in the driver’s’ seat for the future of mobile technology, just like they’ve been for last generations of mobile data. In addition to the core radio technology they have also been aggressive in developing fast and wireless charging, both for handheld devices but also for things like cars. When it comes to cars, Qualcomm recently acquired NXP Semiconductors for $46 billion. NXP are big in automotive technology and safety, bringing new opportunities to Qualcomm at a time when cars get smarter and more connected on a daily basis.

On the processing unit side they are developing the smartphone system on chips which are powering most of the high-end Android handsets. In addition they are using their processing and imaging unit expertise to develop system sets for virtual reality, drones as well as other markets such as datacenter servers.

However, perhaps the biggest opportunity for the coming years is being a core enabler of 5G mobile network technology. Where many companies talk about 5G being important and what it’ll enable, Qualcomm has already developed much of the core technology, have prototype equipment running and a licensing team ready to bring royalties from the other big players.

New Year’s Summary

You already know how important we think it is to set goals, review how you’re doing and adjust for the future. New Year is the ultimate such session, taking what we already do every month and quarter but just kicking it up one notch. Review how you’ve done over the year, both financially as well as for your goals and lifestyle priorities. Have you been able to progress according to your plan? Have you experienced what you wanted to experience? What can you do better for next year?

Almost everyone in the western world makes New Year’s resolutions, with varying results. The difference is that you have the tools and ability to make these reality. Cheer and make your promises like everyone else, but start thinking right away about how to translate these goals into habits that leads along the path to your goal.

Thank you for 2016!

If you’re interested in learning more about how to reach financial independence using dividend growth stocks, check out The Flip.

Disclosure: I am/we are long TGT, AMP, QCOM, IRM.

Additional disclosure: I wrote this article myself, and it expresses my own opinions. This is not financial advice. I have no business relationship with any company whose stock is mentioned in this article. Conduct your own due diligence before investing.