Living The Flip

With a new year, just like every day, comes a chance to start fresh and turn goals into reality. If you haven’t done so in a while, go through your daily and/or weekly routines and make sure that they give you the value you designed them to do and are aligned to each other. We’ve really enjoyed climbing at the gym lately and the recipe to do that without stress or the crowds is to be there when they open on Sundays. That way the rest of the day is free for other activities – and we get to treat ourselves when we get home. This is how we’ve designed this habit:

Climbing

Cue: Sunday mornings when the gym opens (09:00), whenever possible

Routine: Go climbing

Reward: Make and eat Sunday brunch, for example Eggs Benedict, cinnamon roll french toast or scrambled eggs scones

The bonus result is that we’ve made a fair amount of nice brunch dishes which will be published over the spring. So keep your eyes out for these.

Top Five List of Dividend Growth Stocks

Based on the fundamentals of the company, the value from owning it and the price, these are our top investment ideas for a dividend growth passive income portfolio for January 2017:

- Target Corp. (NYSE:TGT)

- Ameriprise Financial Inc. (NYSE:AMP)

- Principal Financial Group Inc. (NYSE:PFG)

- Qualcomm Inc. (NYSE:QCOM)

- Best Buy (NYSE:BBY)

- Bonus: Crown Castle REIT (NYSE:CCI)

Target Corporation has 49 years of dividend increases, most recently 7.1%, with a current payout ratio of 44.0% and a consensus analyst five year EPS growth estimate of 6.0% per year. Their current yield is at 3.59% with an average annual dividend growth rate of 16.1% over the last five years. The stock is trading below fair value at a price of $66.85.

Ameriprise Financial Inc. has 12 years of dividend increases, most recently 11.9%, with a current payout ratio of 40.8% and a consensus analyst five year EPS growth estimate of 9.1% per year. Their current yield is at 2.65% with an average annual dividend growth rate of 27.4% over the last five years. The stock is trading below fair value at a price of $113.42.

Principal Financial Group Inc. has 8 years of dividend increases, most recently 4.9%, with a current payout ratio of 40.3% and a consensus analyst five year EPS growth estimate of 7.1% per year. Their current yield is at 2.9% with an average annual dividend growth rate of 18.1% over the last five years. The stock is trading below fair value at a price of $59.37.

Qualcomm Inc. has 14 years of dividend increases, most recently 10.4%, with a current payout ratio of 55.6% and a consensus analyst five year EPS growth estimate of 10.5% per year. Their current yield is at 3.3% with an average annual dividend growth rate of 19.9% over the last five years. The stock is trading below fair value at a price of $65.13. There’s currently a lot of discussion surrounding Qualcomm and its business practices, with big lawsuits from the FTC and Apple which has led to a sudden drop in its stock price.

Best Buy Corp. has 14 years of dividend increases, most recently 21.7%, with a current payout ratio of 34.5% and a consensus analyst five year EPS growth estimate of 12.5% per year. Their current yield is at 2.5% with an average annual dividend growth rate of 11.9% over the last five years. The stock is trading below fair value at a price of $44.33.

Bonus: Crown Castle International Corp. is the largest provider of wireless infrastructure in the U.S. It became a REIT in 2014 and has a current yield of 4.4%. With the shift to more and more wireless and cellular technologies, this kind type of infrastructure will be essential in the years to come and is separated from the actual operations of the wireless carriers.

Based on our selection criteria, Target has been at the top of our list for quite some time now. The retailer has had its fair share of bad publicity over the last couple of years, from the credit card data breach in 2013, to the bathroom debacle and the pressure on all traditional retailers from Amazon. But behind the scenes they have been working to focus and tune their business to keep being relevant as the landscape changes.

They are working hard with BI and analytics to tune each individual store to its customers as well as not only grow but make its e-commerce symbiotic to the retail locations. They are opening a range of smaller locations in denser urban neighbourhoods, for example Manhattan, which will be even more tailored to their demographic in addition to continuing big investments on their e-commerce platform. E-commerce is clearly a priority with as much investments going to the online back-end platform as to the physical locations.

Target has been in the game for quite some time and been through ebbs and flows before. I believe they are doing the right thing at the right time, but it can take a while for the results to show. Except for the quite severe blip in the 2015 earnings after the data breach fiasco they’ve continuously been making good money and has the dividend nicely covered.

Use your ideas and knowledge to find the best stock or stocks for your portfolio to invest in this month. Doing so will keep you going towards financial independence.

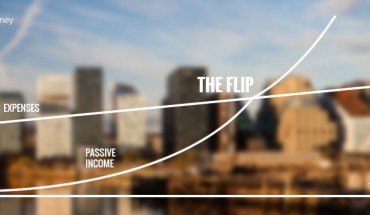

If you’re interested in learning more about how to reach financial independence using dividend growth stocks, check out The Flip.

Disclosure: I am/we are long TGT, AMP, QCOM.

Additional disclosure: I wrote this article myself, and it expresses my own opinions. This is not financial advice. I have no business relationship with any company whose stock is mentioned in this article. Conduct your own due diligence before investing.