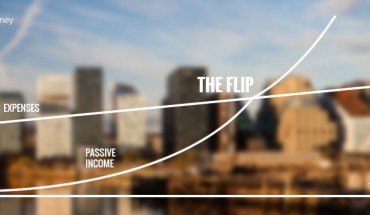

Finally, the 1.0 version of The Flip is finished and published. There’s no earth shattering news or additions, but more of a gentle polish through-and-through. We’ll keep improving it but will only push it out to you once we have any significant additions.

Living The Flip

Like most people growing up I’ve had some ideas and goals on the kind of life I wanted to have when I “grew up”, and have made choices that more or less directly supports that. For the path that I envisioned back then I knew that I had to get a “good job”, for example, and that I needed to invest in order to get more freedom and resources than you get from having a salaried job in Sweden.

Another self-image I had (and still have) is that I wanted to be able to enjoy really good food and wine – of the type that is simply as good as it gets. My interest in wine developed around the time when I started working and as I learnt more I realized that if I wanted to have some mature, really nice wine for special occasions later in life I needed to buy it right away. The reason being that many of the more powerful wines only reach their prime after 5-7 years and many continue to evolve far longer than that.

This past month I turned 35 and decided to close the festivities with a bottle of La Peira Terrasses du Larzac 2006. This bottle was from one of the first times I stood in line outside the wine store in central Stockholm, waiting for hours in the freezing cold together with other wine enthusiasts. Nine years later I got to reap the rewards of the long term goal I set for myself and the decisions and actions I took then. The wine itself was magic – like a Rolls Royce Wraith, powerful but smooth and luxurious at the same time – but not unique. I have many more bottles which I intend to drink, thanking myself for setting up my life in this way every time, and reminding me that the actions I now take for myself in ten years time will eventually come to life.

Top Five List of Dividend Growth Stocks

Based on the fundamentals of the company, the value from owning it and the price, these are our top investment ideas for a dividend growth passive income portfolio for February 2017:

- Target Corp. (NYSE:TGT)

- CVS Health (NYSE:CVS)

- T. Rowe Price Group (NYSE:TROW)

- Qualcomm Inc. (NYSE:QCOM)

- The Gap, Inc. (NYSE:GPS)

- Bonus: Realty Income Corp. (NYSE:O)

Target Corporation has 49 years of dividend increases with a current payout ratio of 44.0% and a consensus analyst five year EPS growth estimate of 9.3% per year. Their current yield is at 3.1% with an average annual dividend growth rate of 16.1% over the last five years and the most recent increase at 5.2%. The stock is trading below fair value at a price of $64.48.

CVS Health Corp. has 14 years of dividend increases with a current payout ratio of 42.6% and a consensus analyst five year EPS growth estimate of 10.7% per year. Their current yield is at 2.5% with an average annual dividend growth rate of 27.7% over the last five years and the most recent increase at 17.7%. The stock is trading below fair value at a price of $78.81.

T. Rowe Price Group has 30 years of dividend increases with a current payout ratio of 45.3% and a consensus analyst five year EPS growth estimate of 6.8% per year. Their current yield is at 3.2% with an average annual dividend growth rate of 11.7% over the last five years and the most recent increase at 3.9%. The stock is trading below fair value at a price of $67.44.

Qualcomm Inc. has 14 years of dividend increases with a current payout ratio of 64.6% and a consensus analyst five year EPS growth estimate of 10.5% per year. Their current yield is at 4.0% with an average annual dividend growth rate of 19.9% over the last five years and the most recent increase at 10.4%. The stock is trading below fair value at a price of $53.43.

The Gap, Inc. has 12 years of dividend increases with a current payout ratio of 55.1% and a consensus analyst five year EPS growth estimate of 4.5% per year. Their current yield is at 4.0% with an average annual dividend growth rate of 16.0% over the last five years and the most recent increase at 4.6%. The stock is trading below fair value at a price of $23.03.

Bonus: Realty Income Corp. is one of the most widely known real estate investment trust (REIT), focusing on retail space (more than 79% of rent in retail). It owns more than 4,900 properties with 248 tenants, many well-known retail companies such as Walgreens, Dollar General and FedEx. It has 77 consecutive quarterly increases of its dividend, with a current yield of 4.2% and 3.95% increase from 2016 to 2017. While not the biggest dividend growth machine, Realty Income has been stable over a really long time (longer than the 23 years since listing on the NYSE) and the dividend is paid monthly, which is a nice bonus.

If you’re interested in learning more about how to reach financial independence using dividend growth stocks, check out The Flip.

Disclosure: I am/we are long TGT, AMP, QCOM, TROW, O.

Additional disclosure: I wrote this article myself, and it expresses my own opinions. This is not financial advice. I have no business relationship with any company whose stock is mentioned in this article. Conduct your own due diligence before investing.