The Flip has found a new home! Check it out on http://www.theflip.nu or the blog on Medium. This is an excerpt from The Flip on how to set a budget framework for your household.

As soon as you start some kind of project or program where financing and economy is non-trivial, as it is in your household economy, budgeting is necessary. It provides a system and framework that guides you to take the choice you’ve decided is the one that leads to your financial goals, instead of guessing every time you make a transaction. At its core, personal budgeting is quite easy but an incredibly important tool for you to live the kind of life you want in a sustainable way.

As soon as you start some kind of project or program where financing and economy is non-trivial, as it is in your household economy, budgeting is necessary. It provides a system and framework that guides you to take the choice you’ve decided is the one that leads to your financial goals, instead of guessing every time you make a transaction. At its core, personal budgeting is quite easy but an incredibly important tool for you to live the kind of life you want in a sustainable way.

Just like for a project, a budget is an enabler. Having a budget for something means that it’s prioritized. Not being able to set aside funds for a specific purpose only means that there are other, more important uses for those funds. Finding out how lifestyle choices translate into budget posts is the most important part of making a budget. This will enable your life priorities and the budget will almost make itself once you’ve defined these.

Describe what defined the life you want to live

Start by writing down and describing how you want to live your life and what this means for you. Next, identify all items that need a budget, such as the type of living or activities, and also the ones that don’t. Make your ideal list where you put a cost or allowance to lifestyle choices. If you want to “live an active lifestyle”, for example, define what this means. One hiking trip out of town per month? Funds set aside for gear? Membership fees? Courses and training?

Sort these in priority with the highest on top and then work your way down to the less prioritized. When you already have fixed expenses, like most of us do, also list these and where they come in the prioritized list – making sure they are covered even though they aren’t fun.

If you’re more than one person sharing the economy in the household, the very first step is to agree on the economic goals and the way the economy is shared. Do you pool all income, divide expenses according to the ratio of income or simply share expenses 50% each? Deciding this is a cornerstone of your shared economy and the first major step in reducing potential relationship friction due to economy. Unless all parties agree to the same economic goals and overall plan the finances will be a constant source of irritation and distrust that will either sabotage the relationship, or if just ignored, make the goals impossible to reach.

The second step is to allow for a personal economy within the shared economy. Treat this as any other type of expense when setting up the shared budget, what these funds are used for is entirely up to the individual and that person should be the only one with access to the account.

There are a couple of expenses each month that are more or less necessary; housing, whether mortgage or rent, and food are the two prime examples. Where these differ is that food is usually a series of expenses throughout the month while housing costs comes as a pair of big bills at the end of the month.

Types of expenses

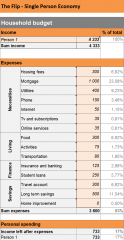

As a result, we have chosen to define two main types of expenses: Fixed and Other. Housing is defined as a Fixed cost, we know that a bill is coming and how big it is, while food is a cost of the Other type where we allocate money for later use.

The Fixed expenses have a specific allocation per item that’s known beforehand each month, the Other expense posts are all divided into general groups and specific purposes but the exact payment details are not known when the money is set aside. They are pooled for later use. Some examples of sub-groups and types of expenses within these two main expense categories:

Fixed expenses

- Housing: rent, mortgage, home association fees, electricity, taxes

- Transportation: car loan, leases, public transportation, taxes

- Long term savings: financial independence, income buffer, retirement portfolio

- Internet and communication: internet, cable TV, mobile phones, subscriptions

- Family: child care, recurring activities, membership fees

- Financial: recurring taxes, tax/financial advisory services, student loans

Other expenses

- Food and household: Groceries, lunch-packs, take-away, family activities

- Spending: Lunch, coffee, clothes, haircuts, drinks, restaurants, vanity – and anything else

- Housing: Maintenance, home improvement, furniture

- Transportation: Fuel, congestion fees, maintenance

- Savings for specific purposes: Personal, car, children’s education, etc.

- Travels

In addition to the expenses you also have the funds you set aside for personal spending and long term savings. By dividing your personal spending money into one pool for day to day spending and one pool for things you need to save up for you make it easier to actually buy the really nice things you want, even when on a budget. This makes our main budget categories look like this:

- Fixed expenses

- Other expenses

- Long term savings

- Personal spending

This list, and any other posts you add to it, is basically where you design your life and what you want to enable through the use of money. Some lifestyle decisions are cheap or even free while other require a substantial financial commitment. Being aware of how much things cost and how you prioritize is the foundation of a sound household economy. Approach this as a design problem where you define what you want to achieve, research and collect needed information, generate and analyze ideas, develop the solution, retrieve feedback on it and finally improve on the solution. We’ll do this step by step in the Blueprint to getting a personal finance system in place chapter.

Create budget variations

By creating a complete list of your current fixed expenses and an idea of what other posts you want to allocate funds to, this information can be used to create budget ideas. Start with the most important posts and work your way down in priority. Create multiple versions and see how one change reduces flexibility or opens up possibilities. If possible, include all household members in this work so that everyone is equally committed once you decide on the final household budget. Test this practice for a couple of months and revise if needed.

A good benchmark is to stay below 40% of the total cash flow in expenses related to housing, such as mortgage, fees, electricity, taxes and so on. With food below 8-10% of the total it should be possible to dedicate at least 10% to long term savings and the road towards financial independence, if that’s what you strive for.

When starting out their adult life most people need to set aside more funds for their housing, either to save up for a down-payment, to pay off a down payment loan or similar. Fixed expenses should still be kept below 60% of total cash flow and reduced as soon as possible. It’s very beneficial to start investing early since compounding interest gives an exponential return on investment over time, so even on a tight budget a long term saving component should be prioritized, and the bigger the better for the first couple of years.

If you think it’s unrealistic to fit your living expenses within these ratios, you’re usually living in the wrong place for your income level or live a lifestyle that you can’t afford. There’s no judgement in this, just facts that you need to be aware of and adjust to. Without a budget you’re basically flying blind when what you need is control. With this control you can design your personal finances to support how you want to live, without proactive planning you simply can’t.

The Flip has found a new home! Check it out on http://www.theflip.nu or the blog on Medium. This is an excerpt from The Flip on how to set a budget framework for your household.