Ever since I was finished with my college degree and started working I’ve used a quite strict personal budgeting system with a long term saving component. The ultimate goal with the long term savings is to provide financial independence from working for an employer through a passive income. This system has worked very well for the last 7 years and I’ve been able to live quite comfortably, buy some nice things and still save towards my financial goal.

My budget setup was inspired by an article in Esquire Magazine where a writer (don’t remember who) proposed to set aside a maximum of 60% of the monthly income for fixed expenses (housing, gym, groceries, transport, etc) and divide the rest into three equal parts. One third for general spending during the month (food bought outside the home, clothing, drinks, etc), one third for bigger items you need to save up to (a new fridge, travels, a nice pair of shoes) and one third for long term savings.

I feel more comfortable spending up to 40% of the household income on fixed costs to provide more flexibility on using the “free” funds and also to have a buffer in case the interest rate on the mortgage goes up.

I started out with around $500 in each of my monthly “thirds” and close to 60% in the fixed costs to pay off the high-interest, top part of a mortgage. It was only after 4 years that I was able to raise my spending account and until then I simply set an automatic transfer from my salary account to a few other accounts with the spending account having a debit card connected to it. I only use credit cards for business expenses I’m being reimbursed for and travels. Living where I do (in the Nordics) this amount has allowed me to live comfortably, buy good quality clothes, shoes and wine and participate in most social activities, but not to be a big spender.

During the last few years I’ve been able to increase this allotment to around $1000 and I can’t really see how more than this is needed for a “normal” kind of life in big cities in western Europe or the USA. Where I used to tap into my “big items”-account for things like clothes and shoes, I now almost never have to touch it and it can be left to things that are a bit more of stretch. Once a comfortable level is reached the exact ratio isn’t that important, any money left in the salary account can be seen as a bonus. I know that it’s easy to spend more than this each month, but until you’re financially independent I believe it’s better to reign in these kinds of expenses.

One of my secrets is that I buy quality products when on sale, if possible. My Loake 1880 and Paraboot shoes that I bought during my first year working are still going strong and look fantastic, I only wish I was as discerning when buying suits and sport jackets during this time. Another habit is that I cook most of my food and only eat out when it’s for getting an experience, not to fill up on proteins and energy.

For my road to financial independence I’ve decided to save and invest in dividend growth stocks. Other types of investments, such as houses for rent, land and bonds, could also be suitable investment vehicles. However, for me I’ve concluded that stocks that have shown a long history of continuously raising their dividends provide the best way for providing a growth of capital that’s at least semi-liquid in nature and to provide a cash stream that will outperform the general inflation.

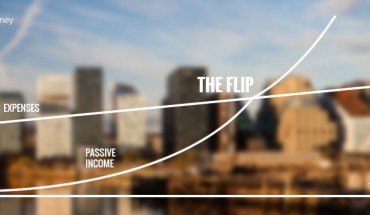

It’s this yield that eventually will provide financial independence or a nice boost in income, actually spending the base capital is not sustainable and can’t be counted as income since it destroys the future value of the capital. Another benefit is that this form of investment is accessible from very small amounts of savings each month. As I said I started out with around $500 per month and it was on my fifth year that I could bump it up.

During that time I saved around $2000 per month but now I’m down to around $1000 per month. The reason is that the extra money invested each month don’t matter as much now as it did earlier. When using a investment vehicle where you get compounding interest by reinvesting the yield and have a long time horizon it’s most important to save up front and since that money will work the most. During the last two years my investment account has grown quite considerably to the point where saving $1000 or $2000 per month doesn’t really matter for the end result. To keep saving is important though, not at least since it’s a free cash-flow buffer that can be used in case the household looses income or interest rates goes up unexpectedly, so I’m still investing $1000 per month.

To help me choose which stocks to invest in I’ve made a simple online tool based on my strategy, http://www.runyourfund.com. It’s a stock screener and portfolio manager that picks out the top scoring stocks according to my criteria which are that they should be financially sound and have risen their dividend for at least 8 years in a row, provide a healthy dividend and be fundamentally undervalued (and this is the basic strategy in a little more detail). Investing in stocks like this every month and periodically re-balancing the portfolio has made me beat the S&P by 50-100% during the last two years (since I started with this strategy). At the same time the yield has been over 3% with a dividend growth of more than 20%.

The beautiful thing with this strategy is that it doesn’t matter if the invested stocks fall in price as long as they continue with their dividend increases. A stock should only be sold if they cut their dividend, the underlying fundamentals change and/or the market changes to the degree that their existence is threatened. If there’s an investment that rises fast in value (it usually is since I invest in undervalued stocks) that particular one can be sold and the investment and profit repositioned into another stock, effectively turbo-boosting the portfolio. So I measure progress in portfolio dividends, not portfolio value, since that’s the end goal.

My original plans was to be financially independent by now, but things such as the down payment on an apartment and paying for a wedding has postponed that somewhat. For this I’m glad, money is not everything and having had this buffer has allowed me to have some freedom. But, with this done I’m looking at a 7 year plan to reach a basic level of financial independence. For this to happen my yearly dividends has to grow from $2700 today to $4050 next year towards a target of $40,000 per year that will provide a basic living for my household. Of course I’d like to grow my yearly dividends far beyond that amount, but one step at a time, eh?